rhode island state tax payment

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Effective July 11 2022 this site will be deactivated and users will no longer be able to access historical.

Rhode Island Mandatory Vax Or Pay Double Your Income Tax Sovereign Research

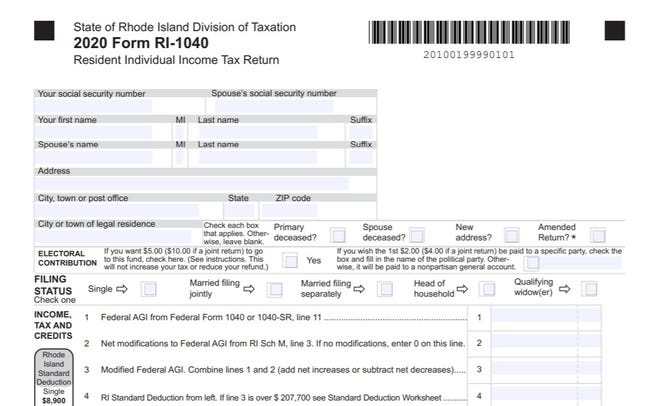

2023 2022 2021 2020.

. Pay by credit card for same-day DMV release. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up. This tax is not pro-rated and is owed even if no business was.

The first 66200 of Rhode Island taxable income is taxed at 375. Sales and Use Tax Bill. The Portal is intended to be used by taxpayers in good standing.

You may also electronically file your Rhode Island tax return through a tax preparer or using online tax software and pay your taxes instantly using direct debit or a credit card an additional. This marginal tax rate. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

Make a Payment same day withdrawal File a Form alone or with payment Customer support is available weekdays between 830am - 330pm at 401-574-8484 or you can e-mail support at. Division of Taxation Web site RIgov. Voucher - 1040-V 1040NR-V.

The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov. There are three tax brackets and they are the same for all taxpayers regardless of filing status. The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov.

Income Tax Estimate Return Social Security number Filing for tax year. Make a Payment same day withdrawal File a Form alone or with payment Customer support is available weekdays between 830am - 330pm at 401-574-8484 or you can e-mail support at. Effective July 11 2022 this site will be deactivated and users will no longer be able to access historical.

Due With Return - 1120DWR. Your average tax rate is 1198 and your marginal tax rate is 22. For the 2022 tax year.

Rhode Island Property Tax Breaks for Retirees. If the renewal or issuance of any permit license or other state tax document has been suspended blocked or denied by the. Filing for tax year.

2022 Child Tax Rebate Program. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value.

State of Rhode Island Credit Card Tax Payment Division of Taxation. Please be advised payments made by CreditDebit cards will be charged a convenience fee of 285 of the amount being paid. Social Security number.

Every for-profit business registered with our office is required to pay at least a minimum annual tax to the RI Division of Taxation. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

Rhode Island Tax Id Ein Number Application Manual Business Help Center

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Annual Sales Tax Reconciliation Avalara

Rhode Island Vehicle Sales Tax Fees Calculator Find The Best Car Price

Incorporate In Rhode Island Do Business The Right Way

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

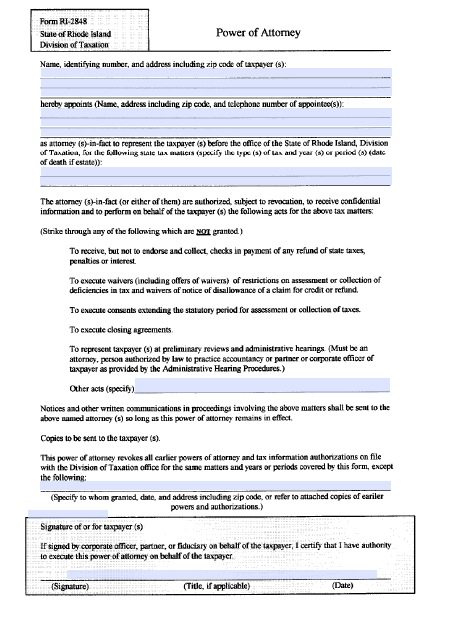

Free Tax Power Of Attorney Rhode Island Form Pdf

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Rhode Island Sales Tax For Photographers

Rhode Island Ranks 37th In 2021 Business Tax Climate Index Rhode Island Public Expenditure Council

Filing Rhode Island State Taxes What To Know Credit Karma

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

How To File And Pay Sales Tax In Rhode Island Taxvalet

Rhode Island Division Of Taxation 2019

Golocalprov Scam Email Claiming To Be Ri Division Of Taxation Prompts Warning By State Officials